Know Your Investor: Alexandria Venture Investments

Shots:

- Know Your Investor’s November Edition revolves around Alexandria Venture Investments, which dedicatedly invests in the healthcare sector

- Established in 1996, Alexandria Venture Investments is based in Pasadena, California, and is the corporate venture capital arm of Alexandria Real Estate Equities

- In 2022, Alexandria participated in 31 investment rounds, with Affini-T Therapeutics receiving the highest amount of funding worth $175 million

Alexandria Venture Investments

Founded in 1996, Alexandria Venture Investments is an integral part of Alexandria Real Estate Equities, a real estate investment firm based in California, United States. The company was named after the city of Alexandria, Egypt, known as the scientific capital of the ancient world, and its relationship with scientific advancements and revolutionary discoveries. Alexandria Venture Investment is a venture capital arm of Alexandria Real Estate Equities solely investing in life science firms.

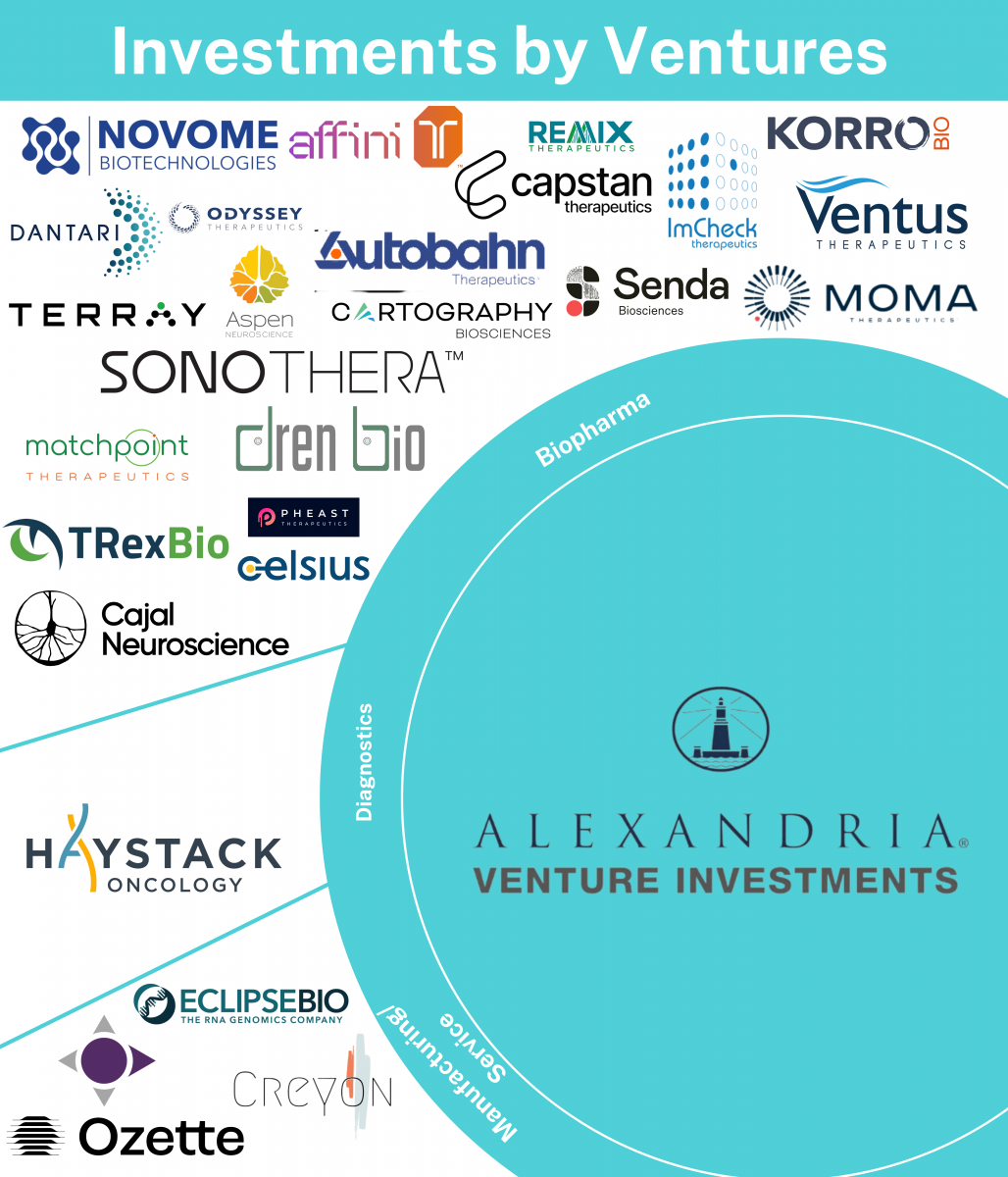

The company mainly invests in seed-stage, early-stage, and growth-stage companies involved in information technology, healthcare, disruptive life science, agrifood technology, and climate innovation sectors. Moma Therapeutics, Ventus Therapeutics, Capstan Therapeutics, Creyon Bio, and Remix Therapeutics, among others, are a part of Alexandria Venture’s portfolio companies. In 2022, Affini-T Therapeutics received the highest amount of funding worth $175M.

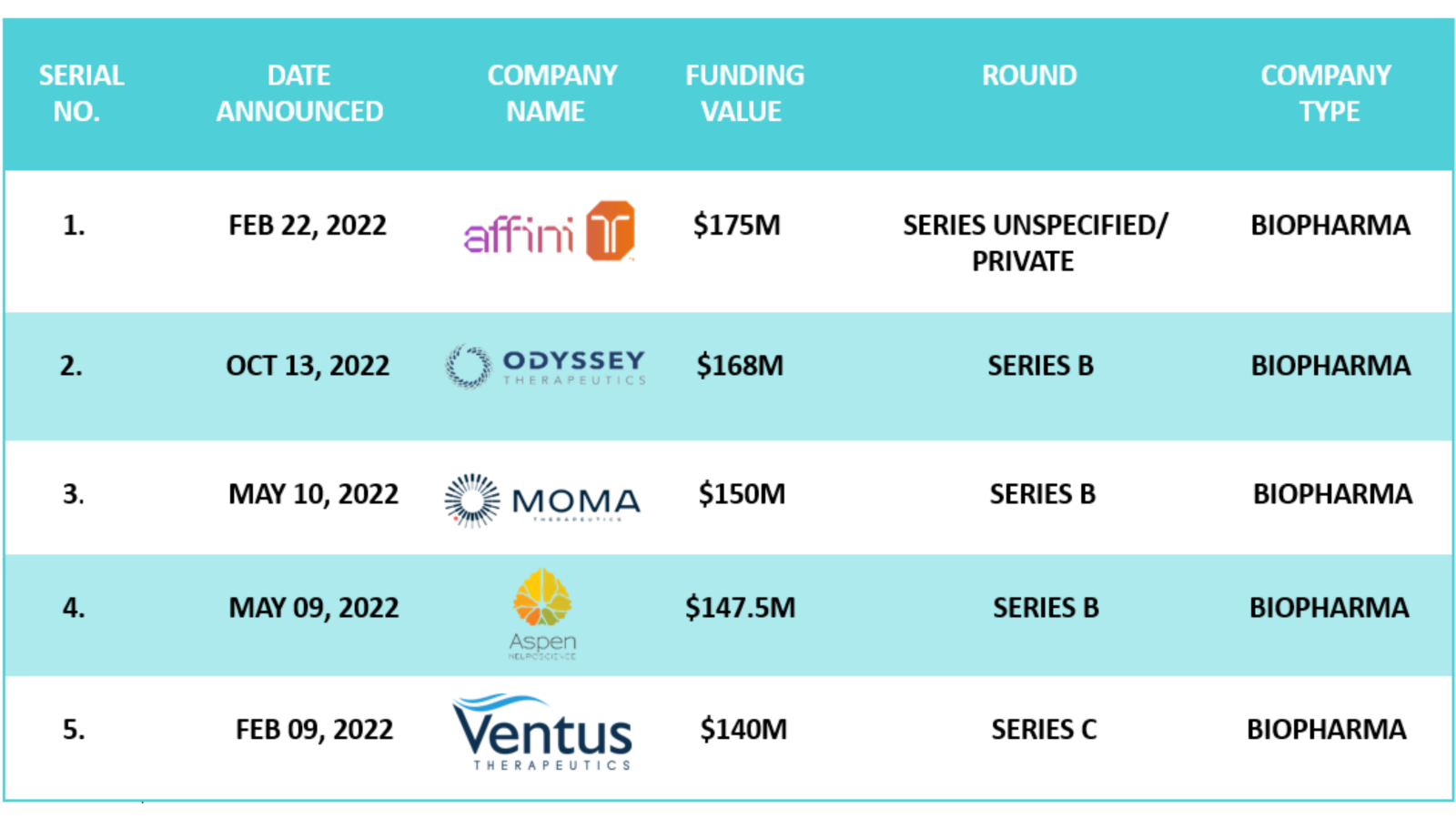

In 2022, Alexandria Venture Investments closed around 31 investment rounds. A significant amount of these investments was made in biopharmaceutical companies, diagnostics companies, and manufacturing, and service providers. Therapy areas, including, Oncology, Autoimmune Hepatic, Inflammation, Neurology, Ophthalmology, and Renal, were focussed by these investments. On the other hand, the company also invested in a series of technologies, including Antibodies, Artificial Intelligence (AI), Machine Learning (ML), Cell Therapy, Diagnostic, Gene Therapy, Genomics, Immunotherapy, RNA, Stem Cell, Small Molecules etc. Additionally, 48.4% of Alexandria Venture’s total investments, in 2022 were made under Series A, whereas 29% were made, under Series B. Alexandria Venture’s top 3 investments of 2022 are as follows:

- Series (Unspecified/Private) funding worth $175M to Affini-T Therapeutics

- Series B funding worth $168M to Odyssey Therapeutics

- Series B funding worth $150M to Moma Therapeutics

In 2022, Alexandria Venture participated in around 11 funding rounds in the first quarter, eight in the second, and six in the third and the fourth quarters respectively. During 2022, the highest investment was in Biopharma companies, including Affini-T Therapeutics, Odyssey Therapeutics, Moma Therapeutics, Aspen Neuroscience, etc. Under Manufacturing or Service providers, Alexandria Venture invested in Creyon Bio, Ozette, Pleno, etc.

Alexandria Venture invested heavily in companies developing therapies associated with small molecules in terms of technology. Odyssey Therapeutics received a total of $168M from Alexandria Venture, while Ventus Therapeutics earned $140M, Senda Biosciences (Sail Biomedicines) $123M, and Matchpoint Therapeutics $70M.

The following table represents the top 5 funding rounds out of the 31 investments made by Alexandria Venture Investments in 2022. (For a complete report, reach out to us at connect@pharmashots.com with the subject line "Alexandria Venture Investments Data")

Related Posts: Know Your Investor: OrbiMed Advisors

Tags

Shivani was a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She was covering news related to Product approvals, clinical trial results, and updates. We can be contacted at connect@pharmashots.com.